Schedule SB – Defined Benefit Plan Actuarial Information

This article has been updated for 2024.

What Is the Schedule SB?

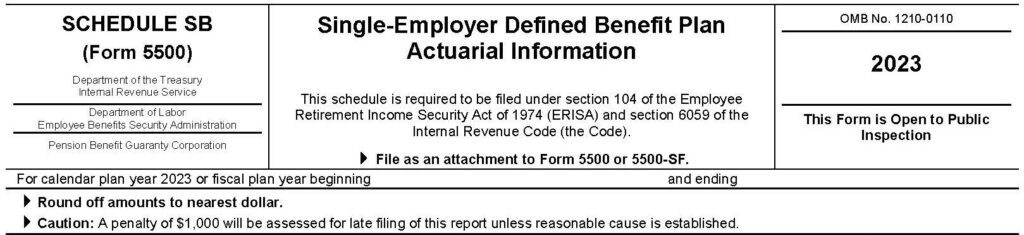

The Schedule SB is an attachment to the Form 5500 series. The schedule reports the funding adequacy of the Defined Benefit Plan. An Enrolled Actuary must certify the figures on the form.

Importantly, the Schedule SB does not show the maximum deductible contribution. Also, it does not show compliance with nondiscrimination testing. Rather, compliance for these items is shown, along with minimum funding requirements, in a separate report.

Do You Need to File the Schedule SB?

If you, as a business owner, have a Defined Benefit Plan, you likely will need to file the Schedule SB. Your TPA or your Enrolled Actuary should let you know if this schedule is required.

When Is the Schedule SB Due?

The Schedule SB is due with the filing of Form 5500. For a calendar year Defined Benefit Plan, the deadline is the July 31st following the Plan year. The employer can extend the deadline to October 15th using Form 5558. Note that the employer need not attach the Schedule SB to one-participant Defined Benefit Plans. Instead, the employer should maintain the schedule in his or her records.

Where Do You File the Schedule SB?

As mentioned, the employer files the Schedule SB with Form 5500. This is typically done electronically. As also described, the employer need not attach the schedule for one-participant Defined Benefit Plans.

Schedule SB Overview

The Schedule SB contains a variety of actuarial information about the Plan’s funding requirements and whether the employer met minimum funding.

By requiring employers to annually report whether they sufficiently funded the Defined Benefit Plan, government agencies increase the likelihood of well-funded Plans.

This article provides a high-level overview of the Schedule SB and is for information purposes only. Preparers should have actuarial expertise, and only an Enrolled Actuary can certify the results.

Defined Benefit Plan Information, Plan Assets, and Liabilities

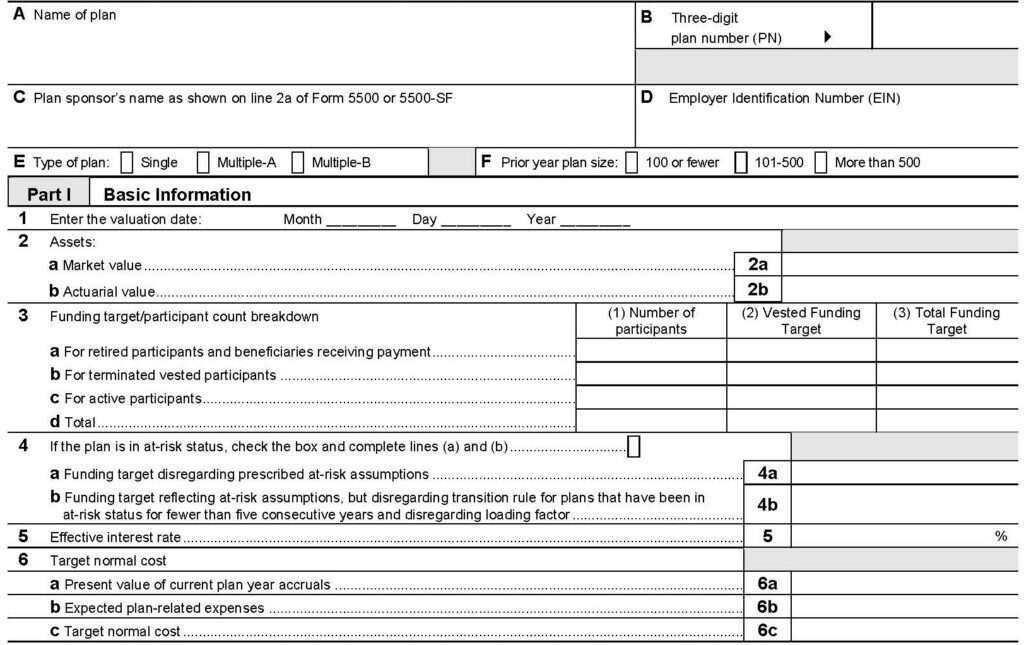

In the first section of the Schedule SB, the actuary includes general information about the Plan and the employer sponsoring the Plan.

The actuary also records the value of Plan assets and liabilities. He or she categorizes the liabilities based on participant status and vesting. If the Plan is “at-risk”, the actuary must calculate “at-risk” liabilities. The “at-risk” status does not apply to smaller Defined Benefit Plans.

Lastly, the actuary must provide the interest rate used to calculate funding liabilities and the value of benefit increases in the current year.

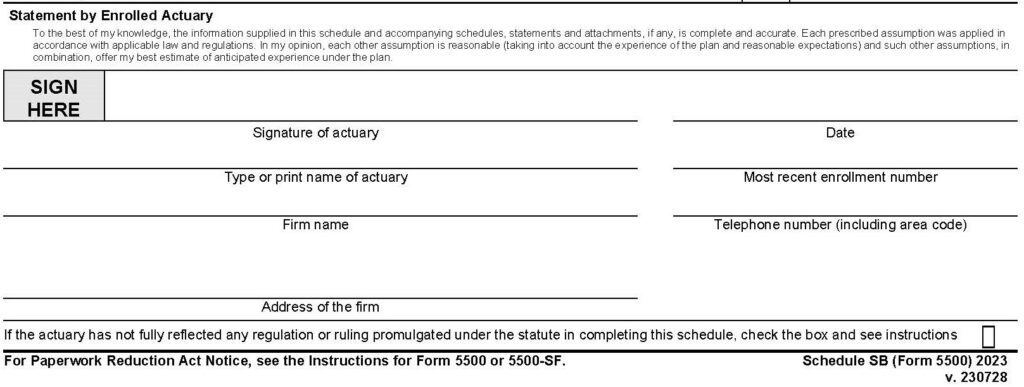

Enrolled Actuary Certification

An Enrolled Actuary must certify the Schedule SB. By signing the schedule, the actuary certifies that the schedule is complete and accurate. He or she also attests that the actuarial assumptions are reasonable and appropriate given the Plan provisions and demographics. If the actuary did not apply any part of the applicable laws and regulations, he or she must indicate that and provide additional information.

Credit Balances

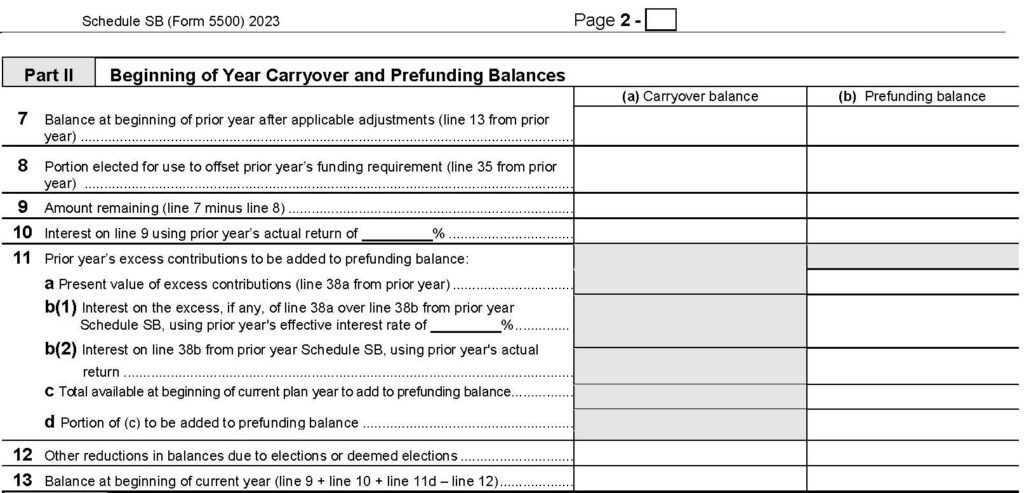

If, in previous years, an employer has funded more than required, he or she may apply excess amounts against current contribution requirements. To do this, the employer must have elected to “store” these excesses, called credit balances, for future use.

The Schedule SB also provides an annual reconciliation of credit balances. As a part of this, the actuary shows interest on prior year balances, additional amounts the employer added, and a reduction for credit balances used. Note that credit balances are divided into two categories depending on when the employer established them.

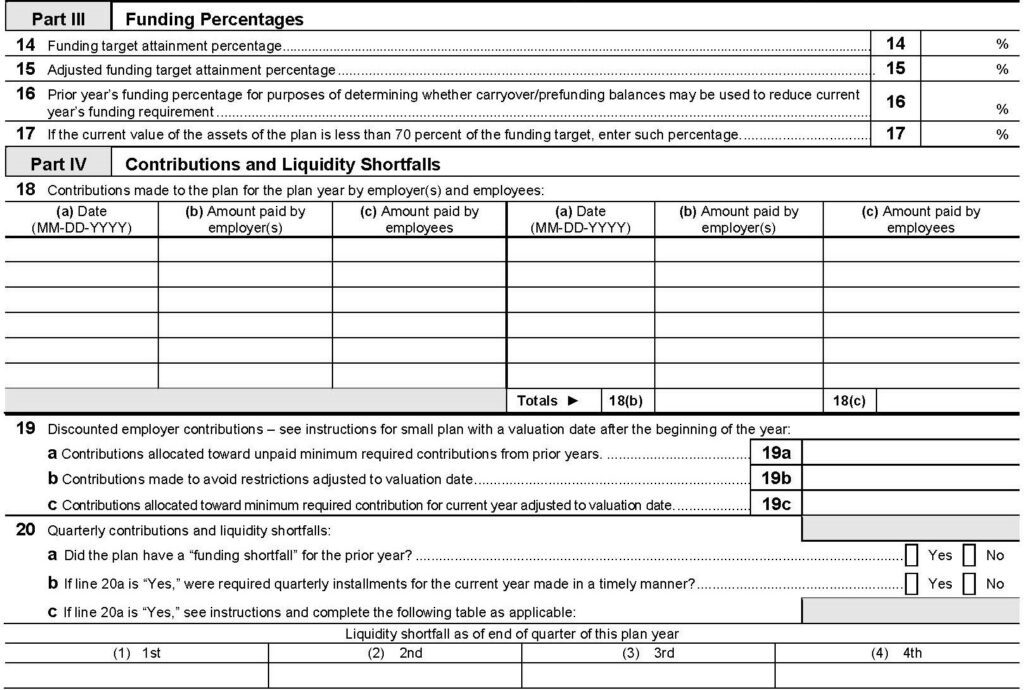

Funded Status and Contributions

Using Plan assets and liabilities on the first page, the actuary calculates the Plan’s current and prior year’s funded status. In some cases, when calculating these ratios, the actuary must subtract credit balances from Plan assets. This reflects that the employer may apply credit balances to reduce required contributions rather than making cash deposits.

The actuary also records contributions made for the current plan year. For calendar year Plans, the employer may deposit Defined Benefit contributions as late as September 15th of the following year. However, contributions are discounted to the valuation date using the Plan’s liability interest rate.

Once discounted, the actuary allocates the contributions by category. The first category is for amounts satisfying late required contributions. If an employer contributes to avoid benefit restrictions (due to poor funding), the actuary classifies these deposits in the second category. The third, and most common, category is for contributions satisfying current-year requirements.

In the last part of this section, the actuary indicates whether the employer was required to and timely made quarterly contributions.

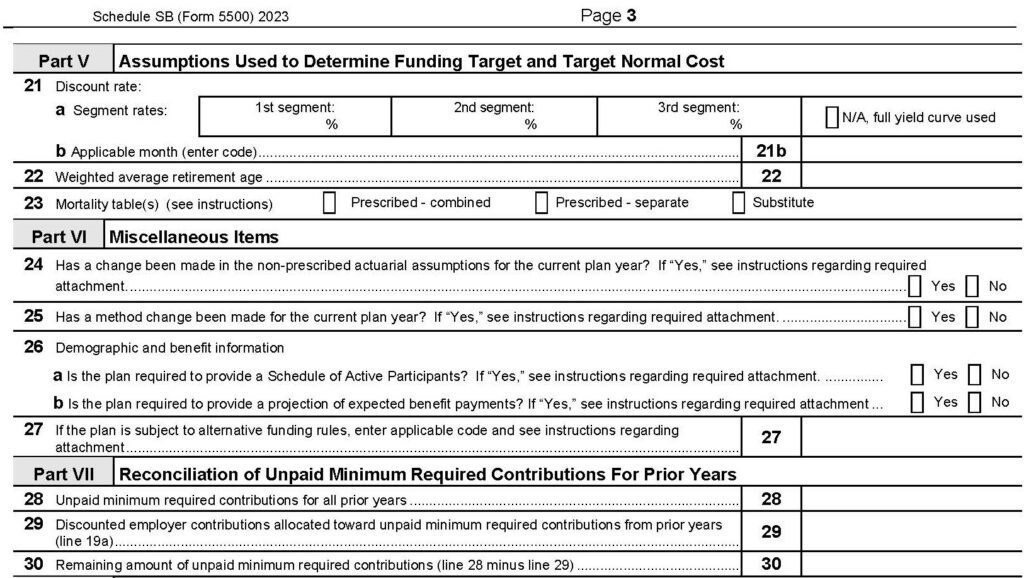

Actuarial Assumptions and Methods, Unpaid Contributions

In Part V of the Schedule SB, the Enrolled Actuary discloses his or her actuarial assumptions. The actuary also must attach a detailed description of the assumptions. In general, regulations prescribe the interest rate and mortality table options available. However, larger Plans may be able to justify a customized mortality table.

In Part VI, the actuary indicates if the assumptions or methods have changed from the prior year and provides in an attachment the rationale for any change. If the Plan is covered by the PBGC, the actuary must include an age/service grid of active participants. Larger PBGC-covered plans also must provide a projection of expected benefit payments.

Lastly, in Part VII, the actuary shows a reconciliation of any unpaid contribution requirements.

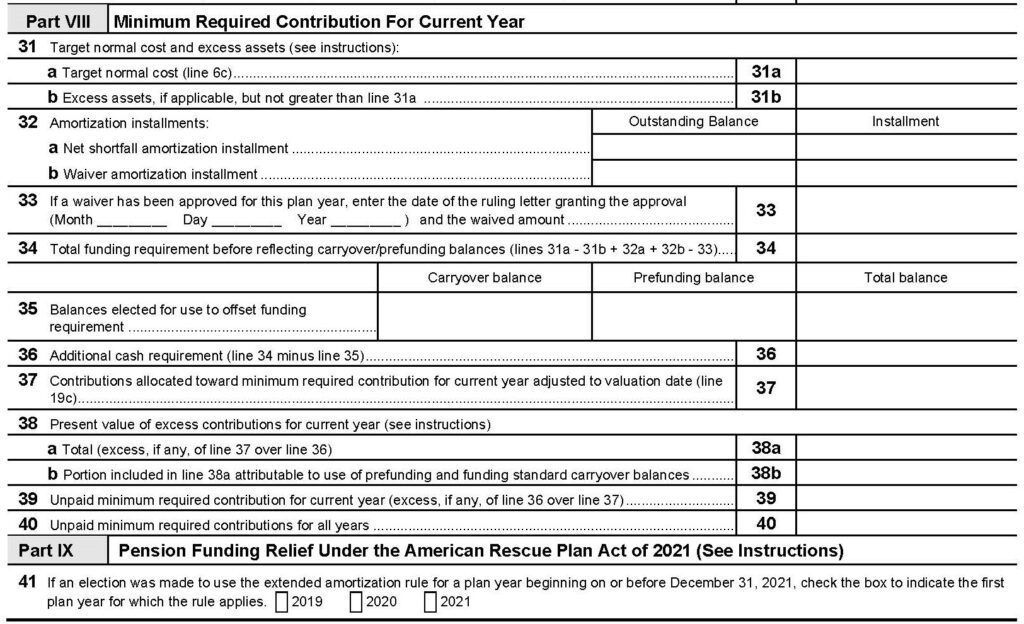

Defined Benefit Plan Required Contributions

Part VIII shows the current year’s contribution requirement. In general, this amount equals the present value of benefit increases in the current year plus an amortization of any unfunded liability. If, on the other hand, the Plan is overfunded, there is no amortization. Rather, the actuary reduces the value of benefit increases by any asset surplus.

If the employer has elected to apply credit balances against the funding requirement, the actuary reduces the requirement for that amount.

To the extent that the employer funds more than the required contribution, the actuary calculates the amount that may be added to the credit balance.

Part IX, the final section of the Schedule SB, addresses funding relief. This section of the schedule is unlikely to apply to small Defined Benefit Plans. This specific funding relief allowed for alternative amortization of any unfunded liabilities. Specifically, employers could have elected a 15-year amortization rather than a 7-year schedule (for calendar year plans, the 2022 plan year and subsequent plan years will use a 15-year amortization).

Summary

Do you need to file a Schedule SB? If you have a Defined Benefit Plan, you probably do. The good news is your actuary should coordinate and complete the filing.

Other Posts:

Telephone:

Email:

info@saberpension.com

Copyright © 2024 Saber Pension & Actuarial Services, LLC

(480) 795-8256

Fax:

(480) 393-8490