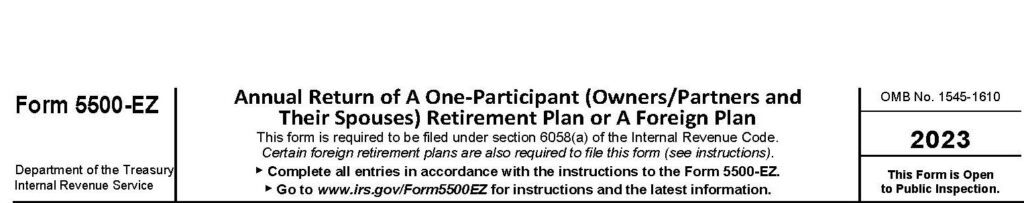

Form 5500-EZ: [Updated] Instructions with Screenshots for Solo 401(k) Plans

This article has been updated for 2024.

If you have a Solo 401(k), you may encounter an interesting situation. First, as a part of maintaining a 401(k) Plan, you may need to file Form 5500-EZ. However, you will likely find that your financial provider does not offer this filing as a service. It’s not that the filing is out-of-scope; your provider just may not provide that service. Period.

So, what do you do? One option is to pay a Third Party Administrator to complete the form for you. A second option is to complete and file the 2-page form yourself.

The purpose of this post is to provide general instructions to complete the form on your own if you have a Solo 401(k). Note that these instructions do not apply to any other type of Plan. Instructions are for the 2023 Form 5500-EZ filing.

Importantly, this article is provided as a courtesy only. You should not rely on it but should verify its accuracy with the form instructions and/or your service provider.

What Is Form 5500-EZ?

Employers who sponsor retirement plans are generally required to file Form 5500 series each year. In some cases, a streamlined version of the form can be used (e.g., Short Form (SF) or Easy Form (EZ)). Assuming Form 5500-EZ applies, the form is filed with the IRS. The filing provides general information regarding plan characteristics, the number of participants, and the level of plan assets.

Where Can You Find Form 5500-EZ?

Do a search for “Form 5500-EZ” and the form and instructions will pop up. Make sure it’s an IRS site.

Do You Need to File Form 5500-EZ?

First things first. Do you need to file the form?

For many new Solo 401(k) Plans, the answer will be “No”. That’s because the filing is only required if the account has assets of more than $250,000 at the end of 2023. Note that for this threshold, all retirement accounts for the employer are added together. For example, your and your spouse’s accounts with the same employer are aggregated. Also, you, your business partners, and all spouse retirement accounts with the same employer are added together.

Regardless, in the final year of the Solo 401(k), a filing will be required.

Also, note that you cannot use Form 5500-EZ if you have any non-owner employees. In that case, you will need to use Form 5500-SF or Form 5500. Although Form 5500-SF is relatively easy, it requires more effort than Form 5500-EZ (it’s called EZ for a reason!). On the other hand, Form 5500 is much more complicated than the EZ and SF versions (don’t be fooled by the 3-page form, you will need to attach all the applicable schedules).

When Is Form 5500-EZ Due?

If you have a calendar Plan Year, the form is due on July 31st of the next year. For example, the 2023 filing would be due by July 31, 2024 for a calendar Plan Year.

The filing can be extended as late as October 15, 2024. Extensions are granted by using Form 5558.

An automatic extension also is granted if the business tax return has been extended. Note to qualify for the automatic extension, the tax year and Plan Year must be the same (generally for smaller employers, both will be on a calendar year basis). Importantly, if the automatic extension is used, Form 5500-EZ is due when the business tax return is due, which may only be until September 15, 2024 for a calendar Plan Year. This differs from the October 15, 2024 deadline when Form 5558 is used to extend the filing.

Where Do You File Form 5500-EZ?

Form 5500-EZ is filed on paper to the following address:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0020

If you prefer to use a private delivery service (e.g., FedEx, UPS, DHL), use the following address:

Internal Revenue Submission Processing Center

1973 Rulon White Blvd.

Ogden, UT 84201

Starting with the 2020 filing, electronic submission is available using the EFAST filing system.

What Do You Need to File?

For a Solo 401(k), Form 5500-EZ is probably sufficient. If, on the other hand, your retirement plan is a Defined Benefit Plan, you will need an additional schedule (Schedule SB or MB), which requires an Enrolled Actuary.

Line-by-Line Instructions Overview

The next several sections provide line-by-line instructions with applicable screenshots. Note that these instructions may not address every situation. As such, this article is not a substitute for professional advice.

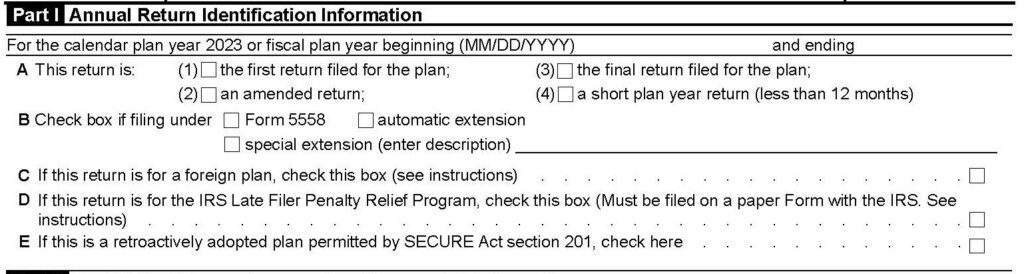

Instructions: Part I

First, you will need to enter the appropriate Plan Year beginning in 2023. This section is easy to miss, so don’t forget to populate the dates. Most likely, you have a calendar Plan Year. If that’s the case, you would enter “01/01/2023” in the beginning section and “12/31/2023” in the ending section.

Line A: Check any of the boxes that apply:

- First return – check this box if this is the first return you have filed even if the Solo 401(k) has existed for more than one year. Since you don’t have to file Form 5500-EZ until assets exceed $250,000, the Solo 401(k) may be several years old when you complete your first return.

- Amended return – check this box if you are amending a previous return.

- The final return – you should check this box if all assets have been distributed from the Solo 401(k). If you checked this box, make sure that line 6(c)(2) is zero.

- Short plan year – this generally will not apply.

Line B: Check the appropriate box if an extension is filed (typically using Form 5558 or the automatic extension). See the section above called “When Is Form 5500-EZ Due” for more information.

Line C: If this is a foreign plan, check this box. Note this article does not cover foreign plans.

Line D: Check this box if you are filing under the Late Filer Relief Program. See the section “Penalties for Not Filing” for more information.

Line E: Check this box if you adopted the Plan during 2023 retroactively for the 2022 Plan Year.

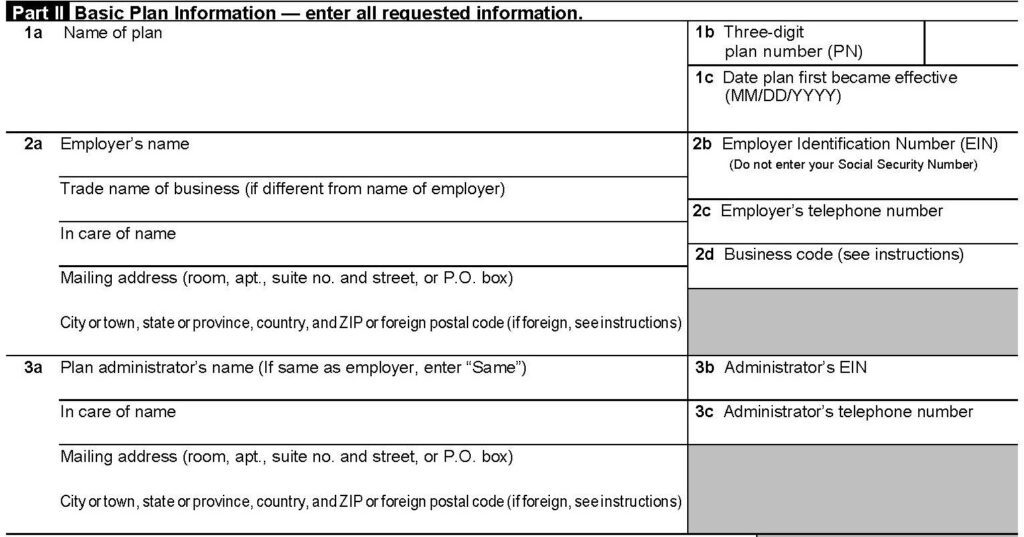

Instructions: Part II, Lines 1-3

This section of Form 5500-EZ is straightforward and will likely be unchanged every year. Assuming you have completed the form correctly in the past, you can copy forward most of the information. The one exception would be the employer’s and plan administrator’s address and phone number in lines 2a, 2c, 3a, and 3c so ensure those are updated, as applicable.

Line 1a: Your Solo 401(k) has a name, so be sure to use it. You generally can find the name of your Plan in the paperwork from your financial provider.

Line 1b: Most likely, the Plan Number is “001”. However, you should verify this in the applicable paperwork.

Line 1c: Enter the effective date of the Plan. This likely will start on January 1 and will be in the Plan’s paperwork.

Line 2: Lines 2a, 2b, and 2c are self-explanatory. You can find the appropriate 6-digit code for line 2d starting on page 10 of the Form 5500-EZ instructions.

Line 3: You will likely enter “Same” on line 3a. Note that you only have to enter “Same” on the first line of 3a for this section. Enter the business’s EIN on line 3b again. You can leave line 3c blank, assuming it is the same as 2c.

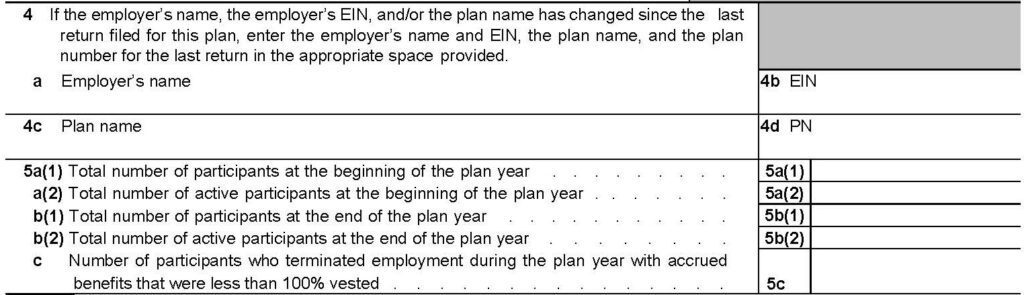

Instructions: Part II, Lines 4-5

Line 4: This generally will not apply. However, if any of these items have changed from the last filing, update them here.

Line 5a(1): Enter the number of participants in the plan at the beginning of the year (likely 1/1/2023). If you are the only person in the Plan at the beginning of the year, enter “1”. If your spouse is in the Plan also, enter “2”.

Line 5a(2): Enter the number of participants in the previous line who are employed with the business that is sponsoring the plan. This generally will be the same number as the previous line unless someone has terminated employment and not rolled over their account.

Line 5b(1): Enter the number of participants in the plan at the end of the year (likely 12/31/2023). If you are the only person in the Plan at the end of the year, enter “1”. If your spouse is in the Plan also, enter “2”.

Line 5b(2): Enter the number of participants in the previous line who are employed with the business sponsoring the plan. This generally will be the same number as the previous line unless someone has terminated employment and not rolled over their account.

Line 5c: This likely will be zero.

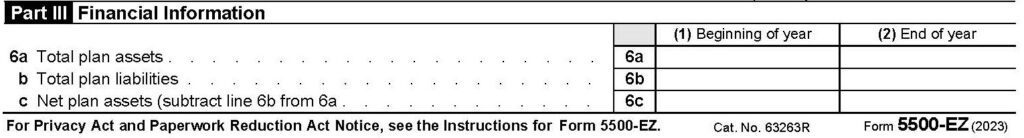

Instructions: Part III, Line 6

Line 6a: Enter the Plan assets at the beginning and end of the year in the two columns. If your account only includes marketable securities, your financial provider (e.g., Schwab, Fidelity, Vanguard) will provide you with the asset values. Assets include rollovers, transfers received from other plans, and investment gains/losses.

You should aggregate assets across all accounts for the employer (e.g., if you and your spouse both have balances with the employer, you would add them together for both columns).

If it applies, assets also include partnership/joint venture interests, employer real property, real estate, loans (participant and non-participant loans), and tangible personal property. If you have any of these items, we strongly suggest engaging a TPA to complete the form for you.

Line 6b: Generally, this would be zero.

Line 6c: Simply subtract Line 6b from Line 6a for both columns.

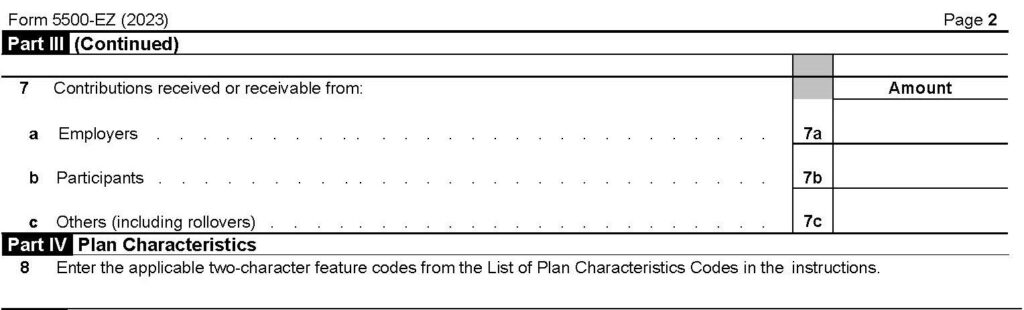

Instructions: Part III-IV, Lines 7-8

Line 7a: Include all employer contributions (e.g., employer match or profit sharing contributions). Remember to aggregate contributions across all accounts for the employer filing this form. Your financial provider should provide you with the amount of employer contributions.

Line 7b: Include all employee deferrals. Again, you should aggregate deferrals across all accounts for the employer filing this form. Your financial provider should provide you with the amount of deferrals.

Line 7c: Include all rollovers. Again, you should aggregate rollovers across all accounts for the employer filing this form. Your financial provider should provide you with the amount of rollovers.

Line 8: Enter the applicable codes shown on page 9. Most likely, this will be 2J and 2E.

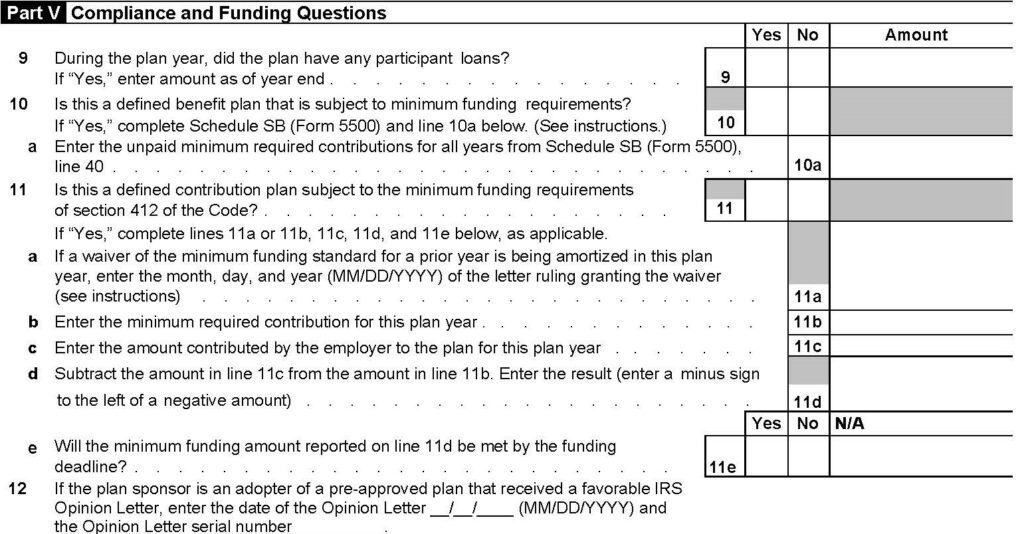

Instructions: Part V

Line 9: Indicate whether there are any outstanding loans and the applicable amount as of the end of the Plan Year (likely 12/31/2023). Your financial provider should send you a summary of your accounts with this information.

Lines 10 and 11: If this is a Solo 401(k), indicate “No” on Lines 10 and 11. Skip Lines 10a, 11a, 11b, 11c, 11d and 11e.

Line 12: If you are using a pre-approved plan (very likely), enter the date of the Opinion Letter and the Opinion Letter serial number. The Opinion letter with this information should have been provided to you when you adopted the Solo 401(k) Plan. If you do not have it, you can request it from the plan custodian.

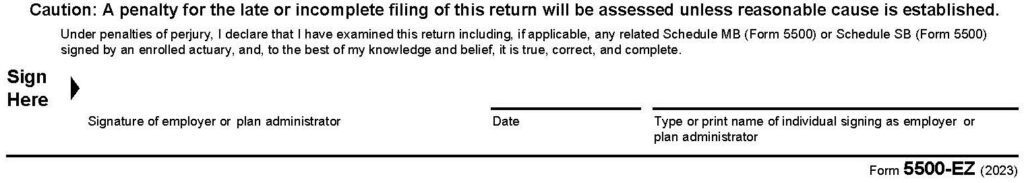

Instructions: Signature

Signature: Don’t forget to sign and date the form using a “wet” signature. Type or print the name of the person signing it as well.

Congratulations, you have completed Form 5500-EZ! If this is your first time completing it, next year should be even easier.

Penalties for Not Filing

For those who do not file Form 5500-EZ on time, the penalty is $250 per day (capped at $150,000 per Plan year). The SECURE Act increased these penalties by a factor of 10! Previously, the penalty for late filing was $25 per day (capped at $15,000 per Plan year). However, in certain conditions, the employer can request a waiver of penalty using the IRS Form 5500-EZ penalty relief program.

If the 401(k) Limit Is Not Enough

If you want to contribute more than your Solo 401(k) allows, a Defined Benefit Plan may permit contributions of $100,000 to $250,000+ per person per year! Try out the calculator to see how much you can contribute!

Other Posts:

Telephone:

Email:

info@saberpension.com

Copyright © 2024 Saber Pension & Actuarial Services, LLC

(480) 795-8256

Fax:

(480) 393-8490