[Updated] The Defined Benefit Plan Actuary. What Is an Enrolled Actuary?

This article has been updated for 2024.

The Defined Benefit Plan Actuary

In general, if you have a Defined Benefit Plan or Cash Balance Plan, you will need an actuary. Being a Defined Benefit Plan, or pension, actuary is a specialty that requires significant education, skill, and continuing education.

What is an actuary and what does a Defined Benefit Plan actuary do? We will address these and other questions in this post.

What Is an Actuary?

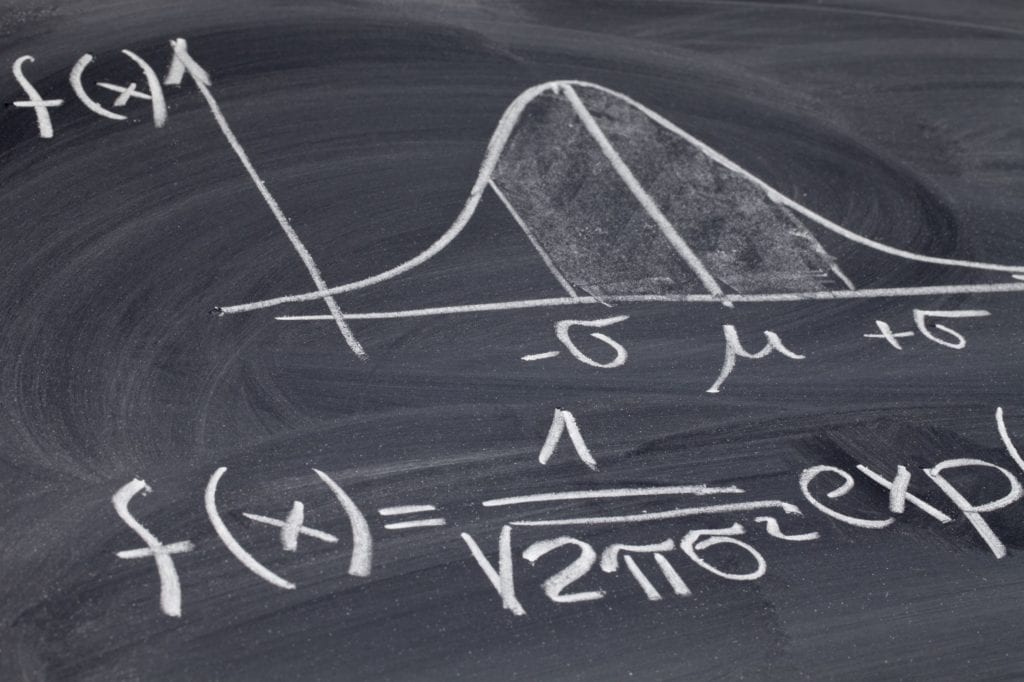

Actuaries are financial professionals who use mathematics and statistics to quantify and manage risk.

For example, life insurance actuaries determine how much insurers should charge for life insurance coverage. In making this determination, actuaries consider the insured’s age, gender, medical history, and a variety of other factors. Setting the cost of life insurance premiums involves an uncertain event, in this case, the longevity of the insured. However, actuaries use historical data, expectations of future life expectancy, and statistical theory to determine an appropriate premium for people with similar characteristics. Actuarial methods mitigate the insurer’s risk. Without actuaries, insurers may incorrectly set premiums or mismatch cash flows (i.e., death benefits paid exceed accumulated insurance premiums).

In summary, actuaries measure and manage risk. How do actuarial principles relate to Defined Benefit Plans?

Context First: What Is a Defined Benefit Plan?

A Defined Benefit Plan is a retirement plan in which an employer promises benefits to its employees. Benefits are often a function of compensation and tenure with the employer. For example, an employer may provide employees a benefit of 2% of pay for every year they work with the employer. In this example, if an employee works for 10 years for the employer and earns $100,000 per year, they would receive an annual pension of $20,000 payable for life (2% x 10 years x $100,000). Some Defined Benefit Plans, particularly small plans and Cash Balance Plans, allow this stream of payments to be paid out as a single sum in lieu of a lifetime annuity.

Is a Cash Balance Plan a Defined Benefit Plan?

Yes, a Cash Balance Plan is a type of Defined Benefit Plan.

In the section above, we described a formula for a traditional Defined Benefit Plan. Cash Balance Plans work differently. For example, rather than providing a lifetime pension starting at the retirement age, Cash Balance Plans credit the participant with an annual amount that grows at a predefined interest rate. At separation from service, the participant may elect to receive a lump sum value equal to the accumulated pay credits.

For instance, assume a Cash Balance Plan provides an annual pay credit of $10,000 at the end of each year. Assume the Plan increases the existing balance at an interest rate of 5.00% per year. In this example, the participant would receive a pay credit of $10,000 at the end of the first year, which would increase to $10,500 ($10,000 x 1.05) at the end of the second year. Additionally, the participant would receive another pay credit of $10,000 in year two, so that the total balance at the end of the second year would be $20,500 ($10,500 + $10,000).

It’s important to note that the Cash Balance Plan actuary keeps track of the balances “on paper”. Unlike a 401(k) Plan, there are no individual accounts. Rather, the employer funds everyone’s Cash Balances together in a pooled account. At retirement, a participant may take a lump sum distribution equal to the account balance or elect an annuity payable for their (and their spouse’s) life. The employer then uses the Plan’s pooled assets to pay the retirement benefit.

What Does a Defined Benefit Plan Actuary Do?

Based on the benefits provided and employee demographics, an actuary for a Defined Benefit Plan estimates the value of employer obligations. The calculation of liabilities considers many variables including expected future compensation increases, asset returns, rates of retirement, disability, death, and other reasons for termination. Actuaries use historical data and future expectations to make assumptions for these variables.

In addition to valuing employer obligations, Defined Benefit Plan actuaries calculate contributions required to fund the Defined Benefit Plans. Note, that the permissible contribution is not a fixed amount. Rather, there is an allowable contribution range. This range allows the employer some flexibility when deciding how much to contribute to the Plan.

When setting up and designing Defined Benefit Plans, actuaries specify the benefit structure in the Plan document. They take into account employee demographics, such that annual contributions meet the objectives of the employer.

Actuaries for Defined Benefit Plans also assist the employer in following laws and regulations regarding pension plans. This includes the timely certification of minimum contributions and the funded status. Compliance also involves time-sensitive government filings and participant notices.

In general, Defined Benefit Plan actuaries have earned the Enrolled Actuary designation. This designation permits actuaries to certify figures related to Defined Benefit Plans.

What Qualifications Does an Enrolled Actuary Need?

Becoming and maintaining the Enrolled Actuary designation requires significant effort and skill. The requirements are as follows:

- Qualifying Formal Education – A bachelor’s degree where the primary area of study is actuarial mathematics or an equivalent number of hours in studying mathematics, statistics, actuarial science, and other representative subjects.

- Examination – A candidate must successfully complete a series of examinations to demonstrate pension actuarial knowledge. For practitioners working towards the Enrolled Actuary designation, this tends to be the most difficult requirement. The exams require extensive study and are extremely difficult to complete. In many cases, pension practitioners with years of experience are unable to pass the required exams.

- Qualifying Experience – A minimum of 36 months of responsible pension actuarial experience or 60 months of responsible actuarial experience with 18 months of responsible pension actuarial experience.

- Ongoing Continuing Education – Within each 3-year cycle, 36 hours of continuing education, subject to the parameters specified.

- Standards and Ethics – An Enrolled Actuary must adhere to a strict set of standards. These standards address the qualification of work performed, prudence, care, conflicts of interest, and professional duty.

Put simply, Enrolled Actuaries must demonstrate a high level of competence, professionalism, and integrity.

Other Defined Benefit Plan Actuarial Designations

In addition to the Enrolled Actuary designation, further credentials demonstrate a greater understanding of pension actuarial knowledge. Specifically, a candidate may obtain the designations of Associate of the Society of Actuaries (ASA) and Fellow of the Society of Actuaries (FSA).

The Associate credential is obtained first and demonstrates a high level of competence beyond the Enrolled Actuary designation. It requires the completion of several more examinations and modules to show a deeper understanding of actuarial principles.

Moreover, if an Associate wants to continue to the highest designation of the Society of Actuaries, he or she can work toward Fellowship. Attaining Fellowship requires even more examinations and further demonstration of pension competence beyond the Associate designation.

Both the Associate and Fellowship designations require an extensive level of pension knowledge when compared to the Enrolled Actuary designation on its own. For example, to become a Fellow of the Society of Actuaries, a candidate must not only demonstrate knowledge of ERISA and the Internal Revenue Code, but they also must pass examinations related to the financial reporting of pension obligations, risk management of Defined Benefit Plans, as well as finance, economics, investments and a wide range of statistical models. Passing these additional examinations generally involves thousands of hours of study.

The Associate and Fellowship designations also require the actuary to comply with another layer of ethical behavior. The continuing education requirement related to these designations also is significantly increased from the Enrolled Actuary requirement.

Do I Need a Defined Benefit Plan Actuary?

In almost all cases, you will need an Enrolled Actuary to help you properly implement, maintain, and wind up your Defined Benefit Plan or Cash Balance Plan. If you require expertise in the financial reporting of pension obligations or the risk management of Defined Benefit Plans, a Fellow of the Society of Actuaries (FSA) will be an invaluable resource.

When selecting an actuary for a Defined Benefit Plan, you should consider:

- Experience and depth of knowledge – Defined Benefit Plans are complicated. You will want to ensure your actuary helps you meet your objectives and comply with applicable regulations.

- Ability to craft an appropriate solution – Your Defined Benefit Plan actuary should be a good listener. Asking the right questions and understanding your objectives and constraints is the first step to creating the right solution. Once your actuary helps you define what you’re trying to achieve, they must have the expertise to craft an optimal plan design.

- Skill in communicating – Communicating technical concepts is a skill. A skilled Defined Benefit Plan actuary should be adept at giving you the right amount of information to allow for a well-informed decision without giving unnecessary detail or going off on tangents.

Where Can I Find a Defined Benefit Plan Actuary

If you need an actuary for your Defined Benefit or Cash Balance Plan, contact us. We provide both actuarial and TPA services for Defined Benefit and Cash Balance Plans.

Defined Benefit FAQs

A Defined Benefit Plan is a type of retirement Plan. Defined Benefit Plans allow you to make very large tax-deductible contributions. In fact, you can contribute as much as $100k to $250k+ per year.

You can payout up to $3.5 million at age 62. If your spouse is employed in the business, you may be able to pay out another $3.5 million! An actuary calculates the annual contributions to fund retirement benefits, which may be as high as $100k to $250k+ per year.

An actuary designs your Plan to meet your target retirement benefit and objectives. Each year, the actuary calculates the level of contribution you need to fund the benefits. At retirement, the Plan pays your benefit, which you can rollover to an IRA.

Yes, Defined Benefits can be rolled over to an IRA. This continues the tax-deferred growth of your Defined Benefit.

Other Posts:

Telephone:

Email:

info@saberpension.com

Copyright © 2024 Saber Pension & Actuarial Services, LLC

(480) 795-8256

Fax:

(480) 393-8490