This article has been updated for 2024. Defined Benefit Minimum Participation What is the minimum participation in a Defined Benefit Plan (“DB Plan”)? This is a common question we get from business owners. To some extent, minimum participation in a Defined Benefit Plan is addressed indirectly in the coverage requirements. However, DB Plans have an […]

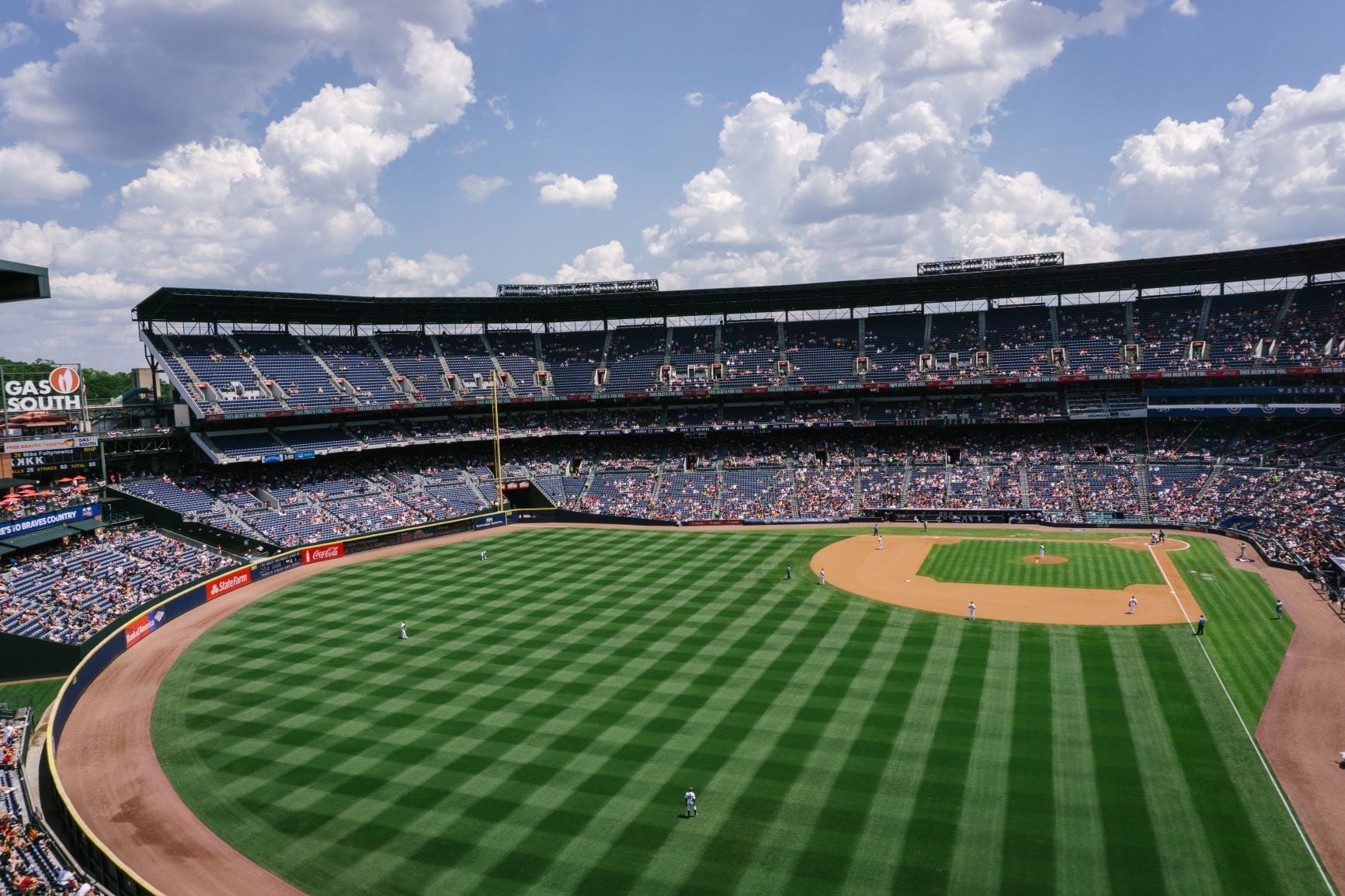

This article has been updated for 2024. If you love baseball, the Spring Training season is a great time of year. For the die-hard fan, it’s an ideal environment to scout your team, meet the players and get autographs. Spring Training is also a reason, if you live in a colder climate, to trade mounds […]

This article has been updated for 2024. Defined Benefit Plan Quarterly Contributions Defined Benefit Plans generally require contributions each year. In some instances, required contributions can be paid all at once. Other times, deposits must be made quarterly. In this article, we will answer common questions regarding quarterly contributions. For example, in what situations are […]

This article has been updated for 2024. Defined Benefit Plan Credit Balances A Defined Benefit Plan (“DB Plan”) is a type of retirement plan that allows for significant tax-deductible contributions. In fact, for a high-income business owner, allowable contributions can be as high as $100k to $250k+ per year. However, Defined Benefit Plan contributions are not […]