This article has been updated for 2024. Introduction A one-owner business often begins as a Sole Proprietorship. Other times, the business is set up as a Limited Liability Company (LLC) without any tax election. In either of these cases, the business would be taxed as a Sole Proprietorship. However, as the business grows, the tax […]

This article has been updated for 2024. Defined Benefit Plan Target Return Rate What investment return should I target in a Defined Benefit Plan? Financial advisors ask us this question quite a bit. While we cannot give investment advice, we will provide you with the information needed to arrive at your own conclusion. Specifically, we […]

This article has been updated for 2024. Your Defined Benefit Plan Attorney Do you sponsor a Defined Benefit Plan? If so, a pension attorney is an important part of your team. Pension attorneys, also called ERISA attorneys, have expertise in the laws and regulations related to Defined Benefit Plans. For small Defined Benefit Plans, pension […]

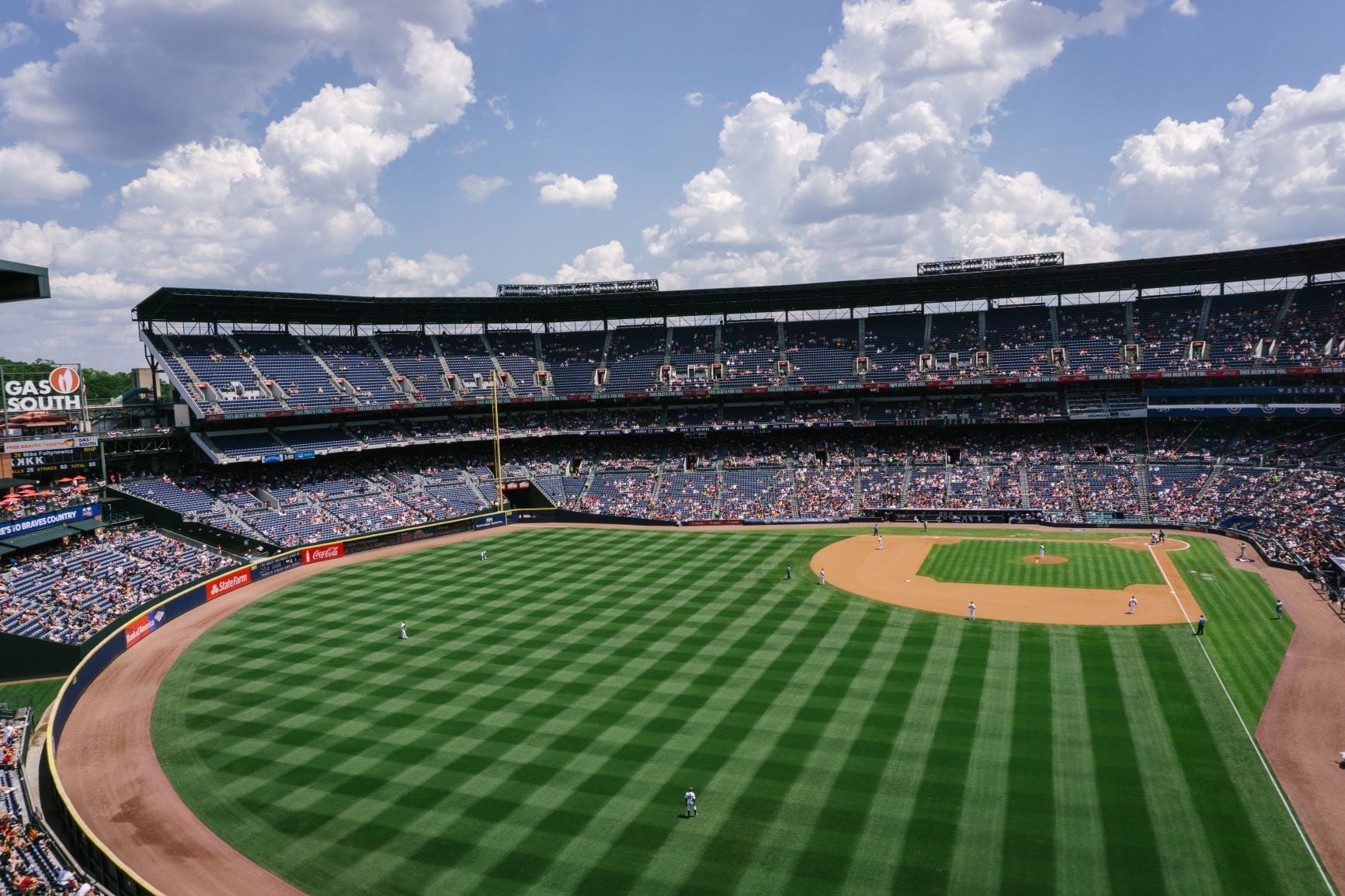

This article has been updated for 2024. If you love baseball, the Spring Training season is a great time of year. For the die-hard fan, it’s an ideal environment to scout your team, meet the players and get autographs. Spring Training is also a reason, if you live in a colder climate, to trade mounds […]